Managed Care Digest Series® Spotlight

Lines of Business Shift in 2020 for Commercial Insurers

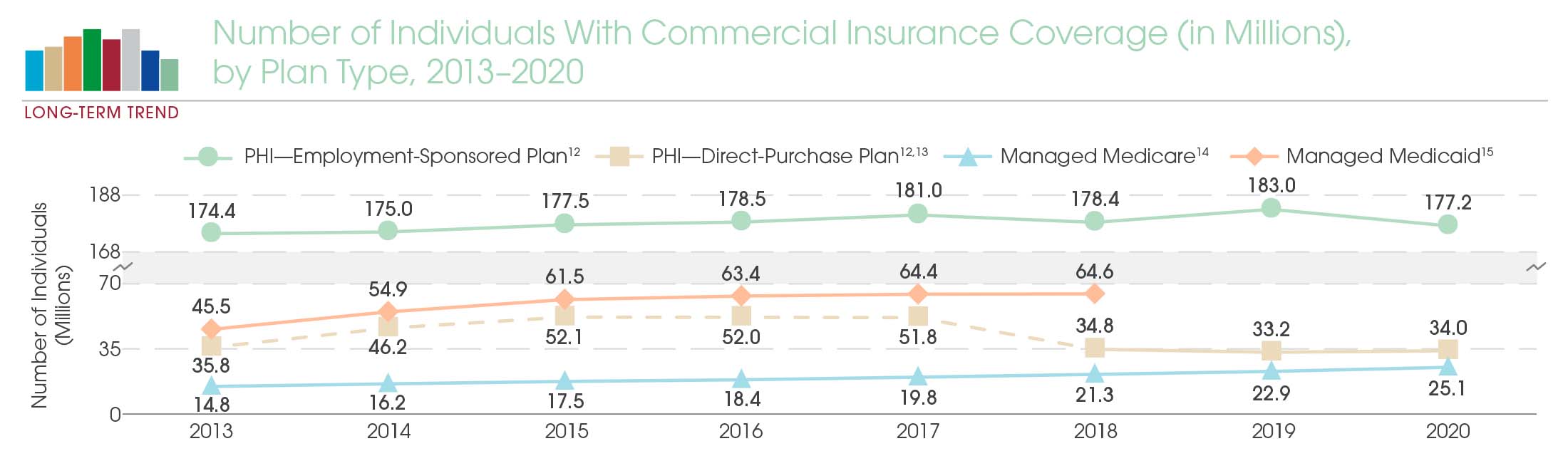

Commercial insurers reported strong earnings in 2020—record levels in many cases—despite a 3.2% annual

drop in employer-sponsored insurance membership.1,2

Elevated earnings were attributable to two factors:

1) pandemic-induced deferral of care; and 2) penetration

into public insurance programs. The drop in medical

utilization in 2020 likely led to the first time—since at

least 1960—that U.S. health expenditures decreased

annually, while the diversification of business lines reflects

a years-long strategy for many insurers (see also page 6).3

With earnings strong and interest rates low, large

commercial insurers are either deleveraging from

previous acquisitions, as in the case of

CVS Health,

or investing further through strategic acquisitions.4

The rise of telemedicine is driving both technology

investments and plan redesigns. For example, virtual-first

plans are meant to capitalize on recent changes

in consumer and provider preferences, while also

delivering on promises to reduce health care inflation.

To enhance its digital strategy, UnitedHealth Group

purchased Change Healthcare, a health analytics

and technology company.5 And in particularly frank

remarks soon before announcing the purchase of

MDLIVE, the CEO of Cigna described sustainability

problems that health care systems face globally.6

Assets tied to public health insurance programs also

remain attractive, especially given recent enrollment

trends.7 In June 2021, Anthem acquired managed

Medicare and Medicaid plans in Puerto Rico from

MMM Holdings.8 Later that year, GuideWell, the parent

company of Florida Blue, announced a similar acquisition

of Puerto Rico-based Triple-S Management.9 Centene,

one of the largest offerors of managed care for public

programs, acquired a technology company, Apixio;

a specialty pharmacy, PANTHERx; and a diversified

behavioral health company, Magellan Health. Centene

announced a major restructuring initiative soon after.10

Finally, to address rising costs and expand its use of

value-based care, Humana completed the purchase of

Kindred at Home in August 2021, instantly becoming the

nation’s largest provider of care in the home.11 Given the

recent struggles of residential long-term care facilities

and the relative success of hospital-at-home programs,

it would not be surprising to see more insurers focus

increasingly on the home as a primary site of care.

Click here to read the 2021 Commercial Payer Digest ™.

Data sources: U.S. Census Bureau and Centers for Medicare & Medicaid Services © 2021

NOTE: Throughout this digest, PHI is private health insurance.

Read More Articles >>